36+ How is borrowing capacity calculated

A communication made in reliance on Rule 134 must contain the statement required by Rule 134b1 and information required by Rule 134b2 unless the conditions of Rule 134c are met. Nothing in the 364200 series shall be construed to relieve any lender of responsibility for any loss caused by lack of legal capacity of any person to contract sell convey or encumber or by the existence of other legal disability or defects invalidating or rendering unenforceable in whole or in part either the loan obligation or the.

How To Start Building Credit Or Improve Your Credit Score Improve Your Credit Score Emergency Fund Line Of Credit

Recovery capacity means the capability of an institution to restore its financial position.

. Common Equity Tier 1 capital means Common Equity Tier 1 capital as calculated in accordance with Article 50 of Regulation EU No 5752013. Inter-bank borrowing agreements where the term of the borrowing is three months or less. They constitute a standardised way of describing the companys financial performance and position so that company financial statements are understandable and comparable across international.

Capacity is an indicator of the probability that youll consistently be able to make payments on a new credit account. Includes motor vehicle loans and all other loans not included in revolving credit. How to know when you can afford to buy an investment property.

International Financial Reporting Standards commonly called IFRS are accounting standards issued by the IFRS Foundation and the International Accounting Standards Board IASB. Using a percentage of your income can help determine how much house you can affordFor example the 2836 rule may help you decide how much to spend on a home. The debt-to-income ratio is one.

If the total amount outstanding and committed on a deferred basis solely for the purposes provided in paragraph 16 to the borrower from the business loan and investment fund established by this chapter would exceed 4500000 or if the gross loan amount would exceed 5000000 of which not more than 4000000 may be used for working capital supplies or. Selected Interest Rates - H15. Investing in property is often seen as the less risky form of investment unlike stocks or managed funds that can require specialised knowledge to get a foot in the door.

A total debt service ratio TDS is a debt service measure that financial lenders use as a rule of thumb when determining the proportion of gross income that is. Federal Heritage Minister Pablo Rodriguez says its time for the CAQ leader to stop dividing Quebecers into us and them. In addition if the communication solicits from the recipient an offer to buy the security or requests the recipient to indicate whether he or she.

The rule states that your mortgage should be no more than 28 percent of your total monthly gross income and no more than 36 percent of your total debt. Complete line 36 only if the organization is a section 501c3 organization and engaged in a transaction over 50000 during the tax year with a related organization that was tax exempt under a section other than section 501c3. Purchasing a property such as a house or unit can be quite profitable - especially if the purchaser takes their time to learn about how to reap.

Industrial Production and Capacity Utilization - G17. See the Instructions for Schedule R Form 990. The standard logistic function is the solution of the simple first-order non-linear ordinary differential equation.

The debt-to-income DTI ratio is a personal finance measure that compares an individuals debt payment to his or her overall income. Debt-To-Income Ratio - DTI. Lenders use different factors to determine your ability to repay including reviewing your monthly income and comparing it to your financial obligations.

All other organizations leave this line blank and go to line 37. Total Debt Service Ratio - TDS. In artificial neural networks this is known as the softplus function and with scaling is a smooth approximation of the ramp function just as the logistic function with scaling is a smooth approximation of the Heaviside step function.

Percent changes are at a simple annual rate and are calculated from unrounded data. Once youve calculated your DTI ratio youll want to understand. How much house can I afford.

All Gens Eevee An Introduction To Ev S Smogon Forums

Free 6 Bank Loan Proposal Samples In Pdf

10 K

S 1

10 K

Sc 20201231

Generating Lasting Wealth Springerlink

Front Page Accounting Cdr N

Buying A House Here Is The Home Loan Application Process If You Need Help Please Call Mortgage Choice Jody Shadg Loan Application Mortgage Mortgage Lenders

Sc 20201231

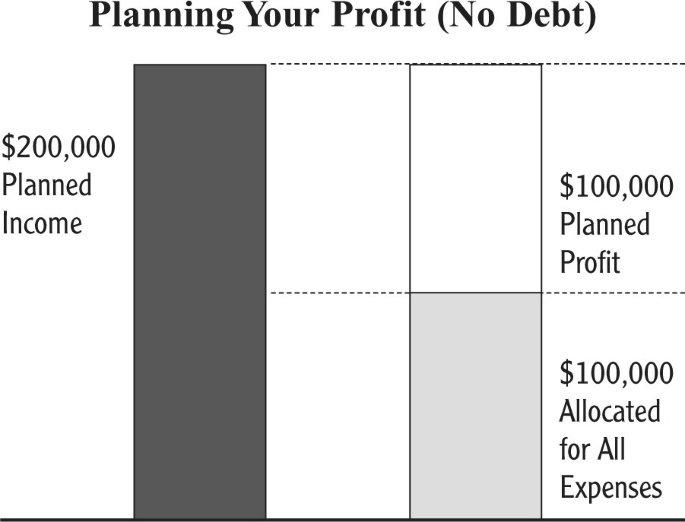

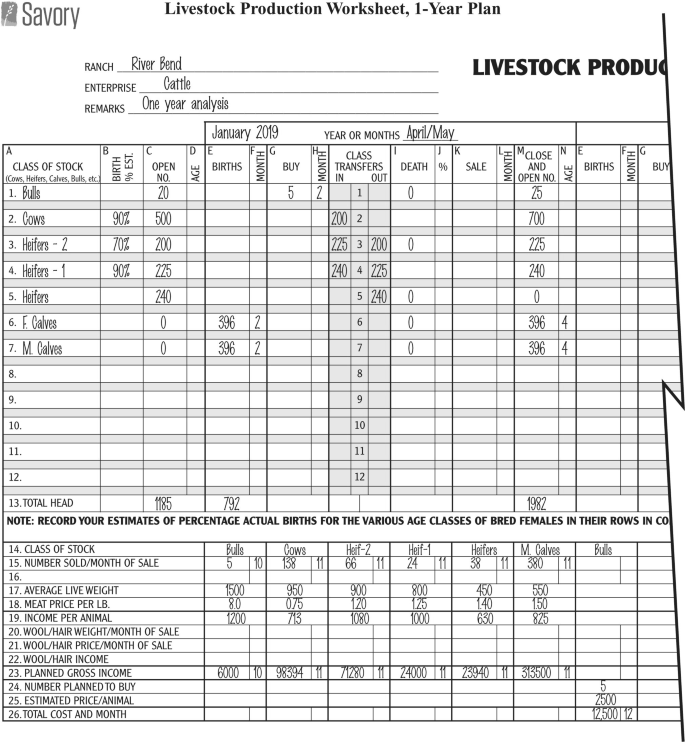

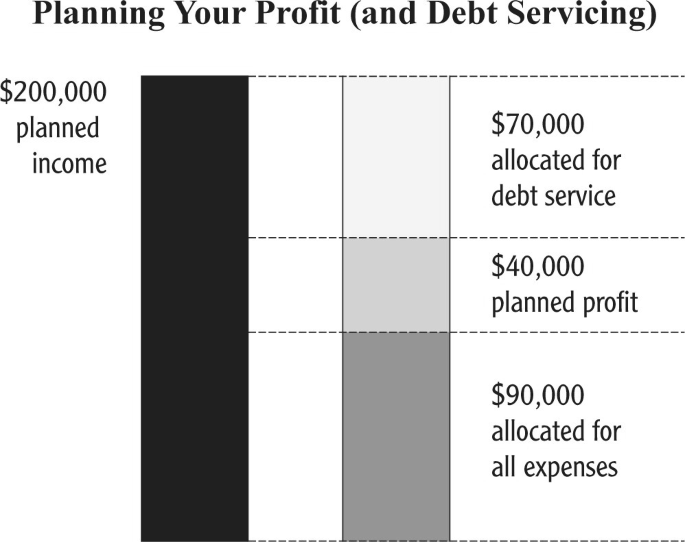

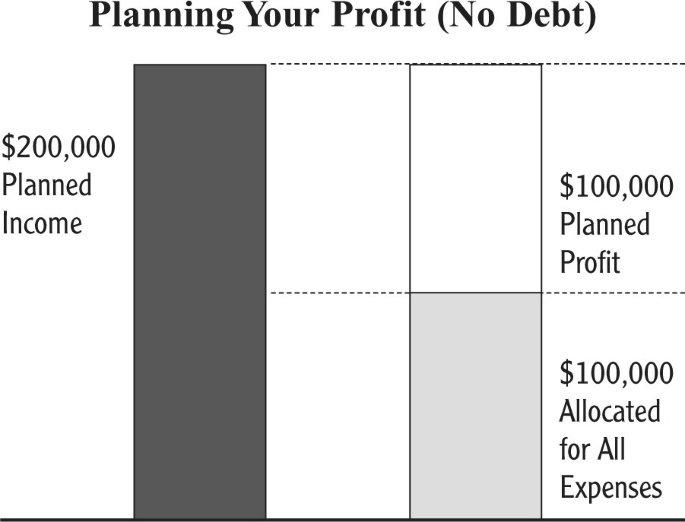

Generating Lasting Wealth Springerlink

2

Sc 20201231

Sc 20201231

Generating Lasting Wealth Springerlink

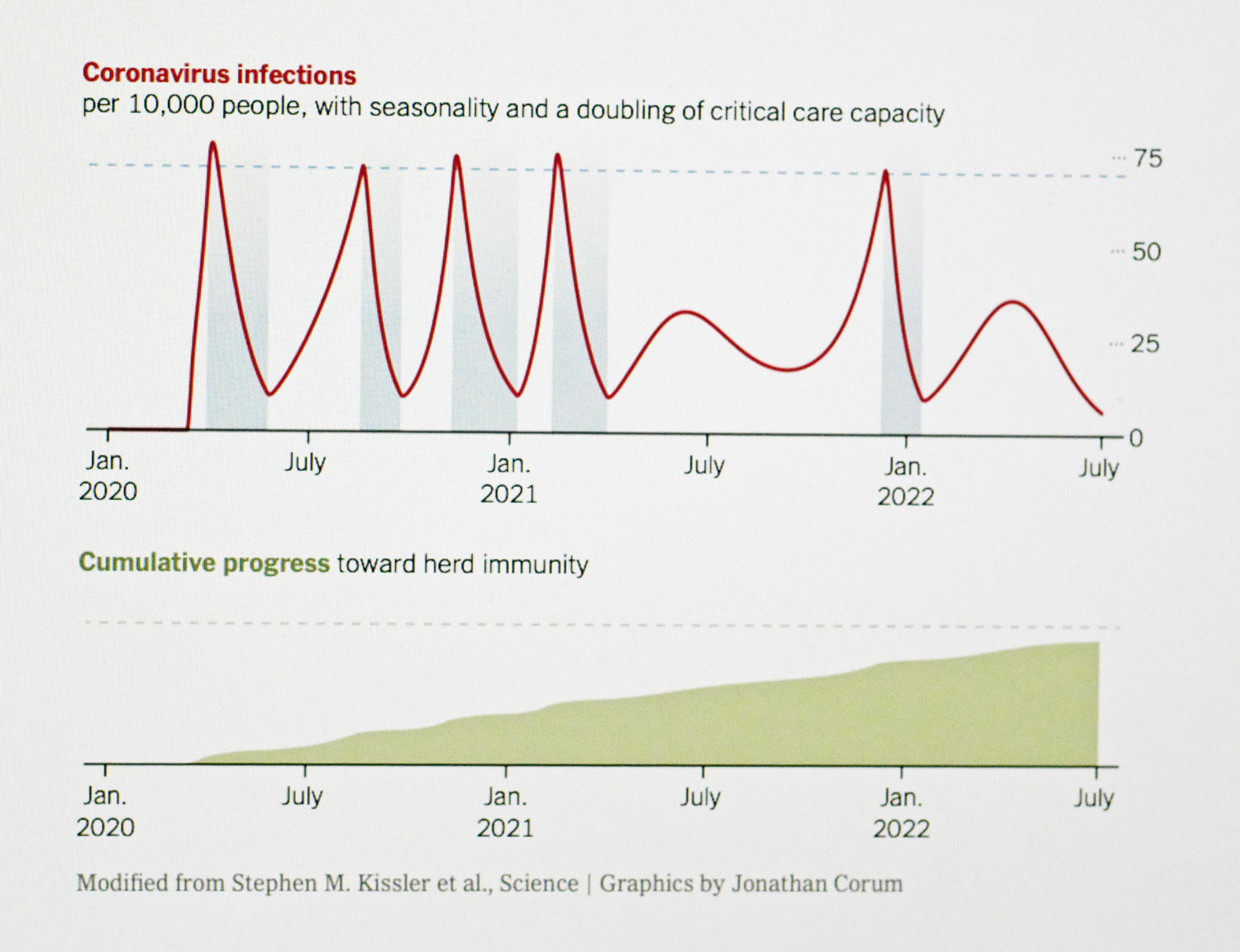

Covid Cyclical Seasonal Graph Jpg

10 K