Sba 504 loan calculator

The fees are calculated on the net debenture amount and are made up of the following components. Send a message.

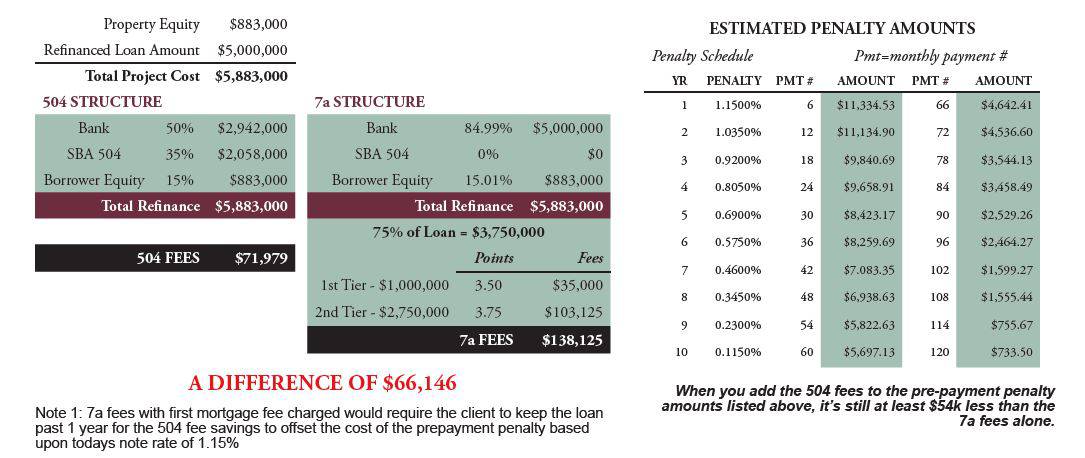

June 2022 Sba 504 Rates Bfc Business Finance Capital

Calculate your monthly loan payments for a small business loan to help you buy start or expand a business.

. This Calculator will provide a simplified estimate of how the SBA 504 REFI program could work using data you provide. Our 504 Loan Calculator is a quick and easy tool that can help you start to conceptualize monthly payments fees and interest costs for projects related to your loan. Calculate your estimated monthly and annual loan payments for a Small Business Loan SBA 504 loan.

Sba 504 loan rates calculator Friday September 2 2022 Edit. The rate you will pay is based on the daily prime rate plus a lender spread. This is the debenture rate not the effective rate.

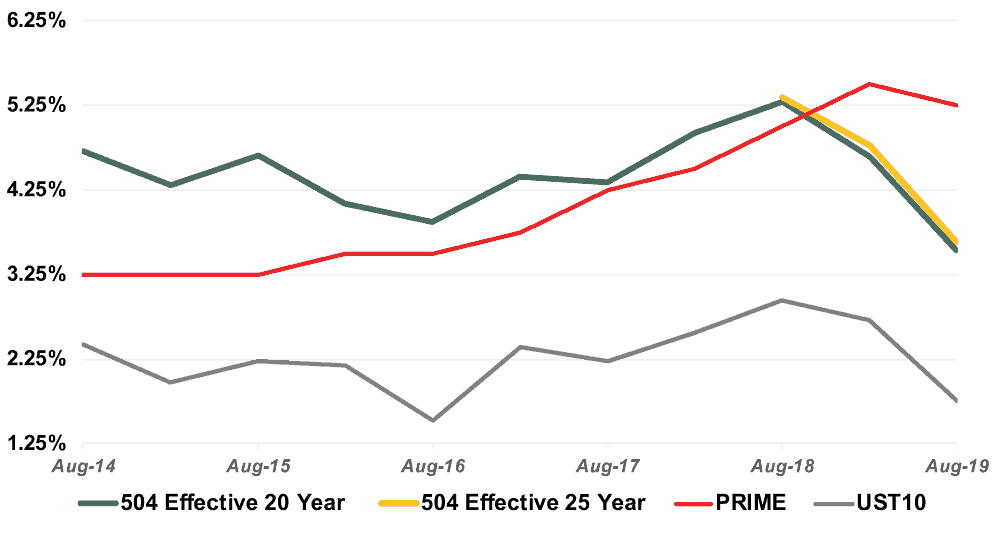

The 504 loan works in conjunction with your local bank resulting in a financing structure typical to a conventional loan but with. Some SBA lenders will require 15 to 20 depending on a variety of factors the most important of which is the owners industry. This calculator assumes a fixed rate.

SBA 504 loans are generally used for real estate purchases according to Mike McGinley EVP of Small Business Banking at Live Oak Bank one of the most active SBA lenders in the country. Free 504 loan calculator. Up to 6 Million.

Using the estimates youve already made for your intended land purchases construction projects and infrastructure improvements you can generate an easy-to-read projection of fees and payments. Bank interest rates and terms are estimated and may be fixed or. Down Payment The SBA requires the borrower to put 10 down in a transaction.

The maximum loan amount for a 504 loan is 5 million. The maximum SBA loan is 5000000. Professional Fees ArchitectEngineering Contingency 10 of Construction Costs Interest on Interim Loan.

To help you better understand how the SBA 504 Loan works and provide you with an estimate simply enter the Estimated Project Cost the loan amount that you are either offered or seeking Bank Loan Term the repayment term in years and the Current Bank Interest Rate. Calculate your SBA 504 loan and get real-time information about rates fees monthly payments and more. SBA 504 Loan Calculator.

This SBA loan calculator might not give an accurate. 7 a loan interest rates can be either fixed or variable. There are a number of fees associated with obtaining an SBA 504 loan.

504 loans are available through Certified Development Companies CDCs SBAs community-based partners who regulate nonprofits and promote economic development within their communities. SBA 504 payments work a bit differently than your typical SBA 7a loan. Calculate your estimated monthly payment.

SBA 504 is a loan product guaranteed by the Small Business Administration for the financing of owner-occupied real estate andor machinery and equipment. This will assist you in finding out your loan payment schedule. Ad Get Access to 1000s of grant apps.

Then multiply the resulting number with the factor set forth below for the. SBA 504 Loan Calculator. SBA 504 Express Loans are Now Available At CMDC for Business Owners How Smart Business Owners are Finding Certainty in Todays Rising Interest Rate Environment.

For certain energy projects the borrower can receive a 504. The actual amount of financing for your project may vary based on the project type number of years in business and appraised value. SBA Loan Amount Our SBA lenders start at 50000.

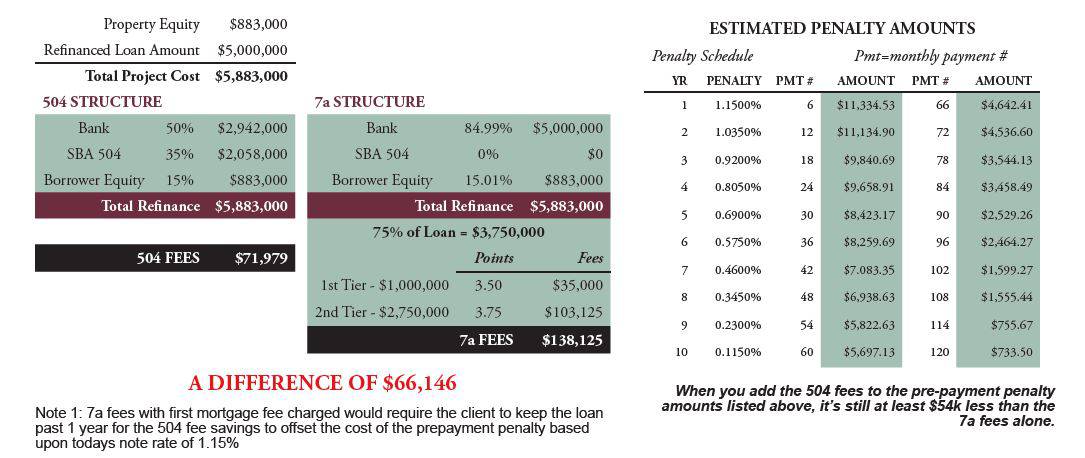

To calculate the prepayment penalty of an SBA 504 commercial loan known as 10-9-8-7-6-5-4-3-2-1 Calculation multiply the remaining balance of the 504 loan with the interest rate stated on the bond Note. LiftFund provides our community an SBA 504 Loan Calculator. Current 504 Loan Rates.

These are one-time only expenses that are financed along with the debenture. For SBA 504 loans. Enter your project cost and loan rates to determine your estimated monthly payments.

The above is an estimated financing structure. If this program looks like it would work for you please contact a WBD Loan Officer who can provide you with a more detailed and accurate estimate of your refinancing package options based on. WBD 504 Refinance Program Estimator.

EIDL and SBA 504 loans. SBA Share of Project Cost. A processing fee of 15 is paid to Amplio for marketing screening packaging closing and general.

Simply enter information below. Land Land and Existing Building Building Land and New Construction MachineryEquipment. Start applying now dont wait.

Here are a few key points to consider with SBA loans. CDCs are certified and regulated by the SBA. Ad Get Business Funding From The 1 Direct Fintech Provider of PPP Loans.

Addressing Myths About Sba 504 Loans Growth Corp

What Is The Difference Between The Sba 504 Loan And The Sba 7a Loan Dakota Business Lending

Sba 504 Loan Calculator Free Loan Calculator Tmc Financing

Spedco Sba Loan Calculator Amazon Com Appstore For Android

504 Loan Calculator Evergreen Business Capital

Sba 504 Loan Definition Rates Calculator Programs

Structuring Your Sba 504 Loan Dakota Business Lending

Very Low Sba 504 Interest Rates Growth Corp

504 Loan Program Mcdc

Sba 504 Loan 101 What Is A Debenture And How Does It Work Bfc Business Finance Capital

The Sba 504 Loan Bfc Business Finance Capital

Sba 504 Loan Rates 504 Rate History Updated Monthly

Build

504 Loan Calculator Big Sky Economic Development

Sba 504 Loan Estimate Your Monthly Payment Growth Corp

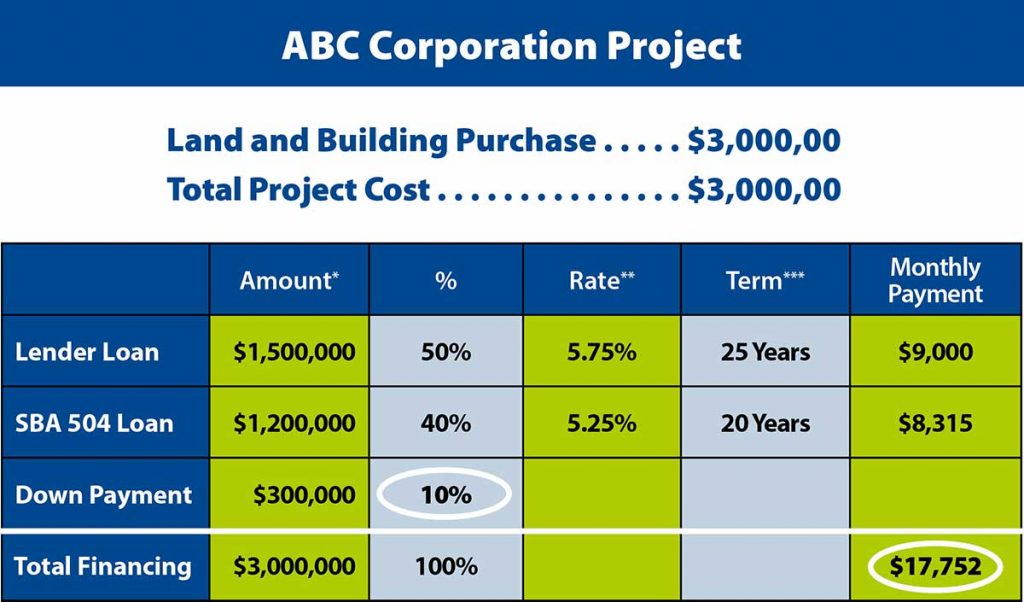

Sample Project California Statewide Cdc

Sba 504 Pace Flex Pace Dakota Business Lending